-

Renaissance-backed Rino Mastrotto brings Prada on board with 10% stake sale

Private equity-backed leather group Rino Mastrotto has sold a 10% stake to luxury fashion house Prada, marking a strategic partnership in the high-end leather supply chain. The deal, supported by Renaissance Partners, includes a cash investment by Prada and the transfer of two tanneries – Conceria Superior in Italy and Tannerie Limoges in France –…

-

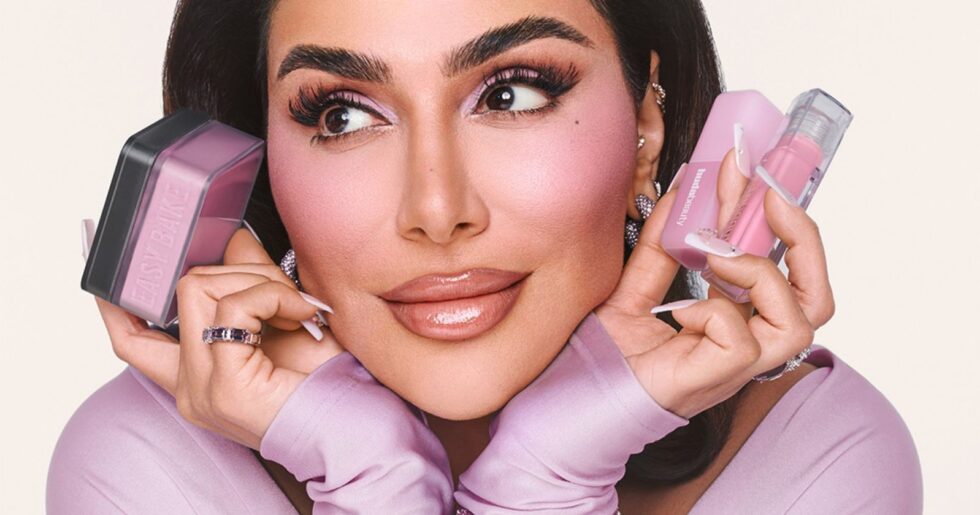

Huda Beauty founder buys back equity stake from TSG Consumer, regaining full ownership

Huda Beauty has returned to full independence following the conclusion of its eight-year partnership with TSG Consumer Partners. Huda Kattan, founder and co-CEO of the global beauty brand, has bought back TSG’s minority stake, regaining full control of the company she launched in 2013. Kattan’s husband, Christopher Goncalo, serves as co-CEO alongside her, while her…

-

MidEuropa hands off Optegra to EssilorLuxottica, fuelling European eye care ambitions

MidEuropa has agreed to sell Optegra, a leading European ophthalmology platform, to EssilorLuxottica. The deal, subject to regulatory approval, is expected to close later this year. Optegra operates over 70 eye hospitals and diagnostic centres across Europe, offering both medically necessary and elective vision treatments. Since acquiring the company in 2023, MidEuropa has driven Optegra’s…

-

Exclusive Interview: Torge Barkholtz is rethinking SME succession through operator-led investing

Torge Barkholtz doesn’t deal in jargon. Nor does he try to dress up succession investing with flashy growth projections or hollow promises. What he’s building at Novastone Partners is far subtler and, arguably, far more ambitious: a re-engineering of how ownership changes hands in the often-overlooked world of SMEs. A founder with ventures spanning gourmet…

-

Goldman Sachs backs Prada’s bold $2.77bn move to revive Versace legacy

Goldman Sachs is spearheading a $2.77bn financing package to support Prada’s proposed acquisition of Versace, according to a report from Italian daily MF. The investment bank is leading a consortium to provide €2.5bn in funding, with €1.5bn earmarked for the purchase of the Capri Holdings-owned fashion house, and the remaining €1bn allocated to revive Versace’s…

-

$1bn Color Wow sale draws private equity interest as beauty sector dealflow accelerates

Color Wow, the fast-growing haircare brand founded by Gail Federici, is exploring a sale that could fetch a valuation of approximately $1bn, according to Reuters. Boutique advisory firm Houlihan Lokey is running the process, which has attracted significant interest from private equity firms and strategic buyers eyeing growth in the premium beauty segment. Color Wow…

-

K-beauty boom fuels $1.6bn deal spree as private equity chases South Korea’s rising stars

South Korea’s booming cosmetics sector has captured the attention of private equity firms, with 18 deals totalling KRW2.3tn ($1.6bn) recorded in 2024, according to Bloomberg. The sharp rise in M&A activity comes as the country becomes the top cosmetics exporter to the US, overtaking France. Strong US demand, powered by K-pop and K-drama-driven brand visibility,…

-

Prada nears landmark Versace acquisition in a €1.5bn power play

Prada is nearing a deal to acquire Versace for nearly €1.5b, in what could be one of the biggest shake-ups in Italian luxury. According to sources close to the negotiations, Prada and Capri Holdings – Versace’s parent company – are expected to finalize the deal this month, provided talks remain on course. The acquisition would…

-

L Catterton-backed Birkenstock faces legal hurdle in design protection effort

Birkenstock, the German footwear brand backed by private equity firm L Catterton, lost a key legal battle as Germany’s highest civil court ruled that its sandals do not qualify as copyrighted works of art. The decision allows competitors, including retailer Tchibo, to continue selling similar models, posing a challenge to Birkenstock’s brand protection strategy. L…

-

1686 Partners invests in luxury eyewear brand Ahlem to drive global expansion

Ahlem, the Los Angeles-based luxury eyewear brand, has secured its first external investment from Luxembourg-based private equity firm 1686 Partners. The firm, which specializes in purpose-driven lifestyle companies, will support Ahlem’s global growth by enhancing its retail footprint, client services, wholesale operations, marketing, and production capacity. While the financial details of the transaction remain undisclosed,…